by Dan Linnaeus (@DanLinnaeus)

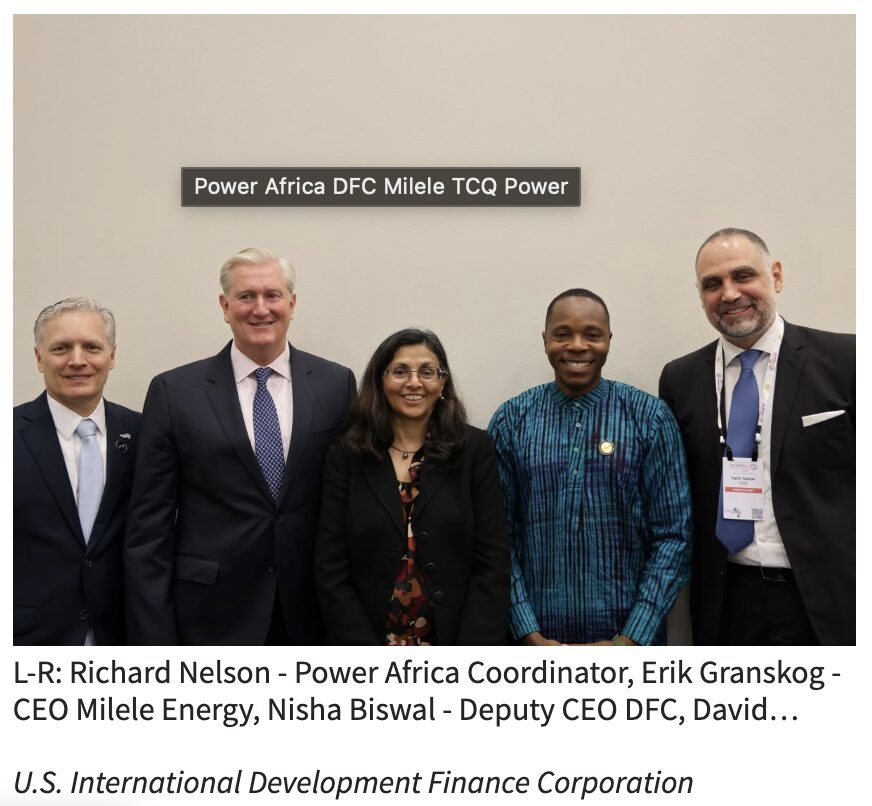

Between 2022 and 2024, Anthony Podesta earned $1.12 million lobbying for Gemcorp. In 2024, his brother John Podesta approved $412 million in DFC funding for Milele Energy, a portfolio company of Gemcorp Capital.

Why it matters: Gemcorp, Milele’s primary backer, has documented historical ties to the Kremlin, as well as connections with sanctioned Russian defense firms and financial institutions. These associations raise concerns that transcend potential conflicts of interest to implications of misalignments with U.S. interests and its global posture. This is particularly alarming when viewed in the context of Gemcorp’s 2022 cooperation in a $1 billion Memorandum of Understanding (MoU) in Bulgaria with U.S.-based nuclear technology firm, IP3.

IP3 advocates for nuclear energy projects in emerging markets, positioning itself as a facilitator for Western-aligned energy infrastructure and presented as a counterbalance to Russian and Chinese influence. However, its involvement in the Bulgarian MoU with Gemcorp raised questions due to Gemcorp’s Kremlin links, creating a potential risk of exposure to sensitive energy and nuclear information, especially since the MoU didn’t detail clear security assurances or mechanisms for safeguarding IP3’s technology against misuse or data breaches once shared with third parties.

[MoU: Tribune.bg. (2014). Доклад Комисия Джемкорп – Tribune.bg. Scribd. Available from: https://www.scribd.com/document/618011089/%D0%94%D0%BE%D0%BA%D0%BB%D0%B0%D0%B4-%D0%9A%D0%BE%D0%BC%D0%B8%D1%81%D0%B8%D1%8F-%D0%94%D0%B6%D0%B5%D0%BC%D0%BA%D0%BE%D1%80%D0%BF-Tribune-bg]

Sberbank (May 6, 2024) and VTB Bank entities (April 2, 2024), previously on the U.S. Specially Designated Nationals List (SDNL), were removed shortly before the DFC funding approvals (May 8, 2024) potentially strategically to facilitate the processing and approval of the $412 million loan and political risk insurance package, without the legal or financial restrictions that accompany SDNL designations. The targeted, specific delisting of these entities may have aimed to open related and otherwise blocked financial pathways, perhaps in alignment with a broader geopolitical or economic strategy, perhaps with improper financial interests at play. Since the portfolio holder, Gemcorp, has documented connections to Russian state interests, these removal raise legitimate avenues of inquiry into potential exposure of U.S.-aligned financial institutions or projects to indirect influence or strategic leverage by these Russian entities, [See Key Timeline Source in References for the list of Treasury actions and links].

————

Table of Contents:

Key Timelines

Overeview: Gemcorp-Milele Relationship and U.S. Involvement

Introduction: Gemcorp Scandal Toppled Bulgaria’s Government

Part I: Gemcorp & Milele Energy

Part II: Protos Energy & INSA Oil

Structured Timeline

References

Key Timelines

- 2024 Key Lobbying and Funding Timeline

- Timeline of Key U.S. Administration Roles

Overview: Gemcorp-Milele Relationship and U.S. Involvement

- Milele Energy and Gemcorp Capital: Investment and Ownership Structure

- Financial Structure of the DFC Loan

- Benefits to Milele Energy and Concerns over Russian Linkage

- Implications of Russian Connections

- Geostrategic Considerations of Russian Involvement

Introduction: How a U.S. Lobbyist Helped Bring Down the Bulgarian Government, Left Ukraine Vulnerable in the Lead-Up to Russia’s Invasion, and Secured $412 million in U.S. Funding for Russian Defense-Linked Firms

PART I: GEMCORP & MILELE ENERGY

- Background: Tony Podesta’s Return to K-Street & John Podesta’s Involvement

- John Podesta’s Role in the Biden Administration

- Legal and Ethical Concerns

3.1 Article 502 of §2635, 5 C.F.R.- Personal and business relationships

3.2 Articles 702 and 702(a) of §2635, 5 C.F.R. – Use of public office for endorsement or private gain

3.3 Executive Order 13989 – Ethics Commitments by Executive Branch Personnel

3.4 Foreign Agents Registration Act (FARA) – 22 U.S.C. §611 et seq.

3.5 Gemcorp’s Shareholding Structure and Implications under §136 of U.K. Companies Act 2006

3.6 Strategic Timing of Disengagement

3.7 Lobbying Efforts Directed at Government Representatives - Overview of Gemcorp’s Ties to the Kremlin

4.1 Concerns Over the Podesta Brothers and Russian Influence

4.2 Gemcorp’s early investors: Albert Avdolyan and Sergey Adoniev

4.3 Gemcorp’s co-founder and CEO, Atanas Bostandjiev (Bostandzhiev), the collapse of VTB and Ties to Delyan Peevski

4.4 Sberbank, Ruben Vardanyan, and the Troika Laundromat

PART II: PROTOS ENERGY & INSA OIL

- Russia’s Geostrategic Shaping Operations

- Podesta-Peevski Ties

- Potential Legal and Ethical Implications

Structured Timeline

Further Investigations

References

————

Key Timelines

1. 2024 Key Lobbying and Funding Timeline:

- March 6, 2024: John Podesta replaced John Kerry as Climate Envoy with oversight over USAID and DFC projects, stepping up from his 2022 appointment as Senior Advisor to President Biden for International Climate Policy.

- April 1, 2024: Gemcorp terminated its contract with Tony Podesta, marking the end of his registered lobbying for the firm.

- April 2, 2024: VTB Bank EUROPE SE aka DEUTSCHLAND AG, removed from Russia related SDN List by OFAC.

- May 6, 2024: SBERBANK (SWITZERLAND) Ukraine-/Russia-related Designation Removal from SDN List.

- May 8, 2024: John Podesta approved $412 million in DFC funding for Milele Energy, a Gemcorp subsidiary.

2. 2024 Key Lobbying and Funding Timeline:

- May 3, 2021: Samantha Power was sworn in as the Administrator of the U.S. Agency for International Development (USAID).

- September 2022: John Podesta was appointed Senior Advisor to President Biden for Clean Energy Innovation and Implementation, overseeing the implementation of the Inflation Reduction Act. In this role, he managed over $370 billion in federal investment for clean energy and climate-related projects.

- March 6, 2024: John Podesta replaced John Kerry as Climate Envoy, placing him in a high-profile role within the Biden administration within the National Security Council at the forefront of international climate negotiations and policies related to the U.S. posture on global energy and environmental issues.

Overview: Gemcorp-Milele Relationship and U.S. Involvement

- Milele Energy and Gemcorp Capital: Investment and Ownership Structure

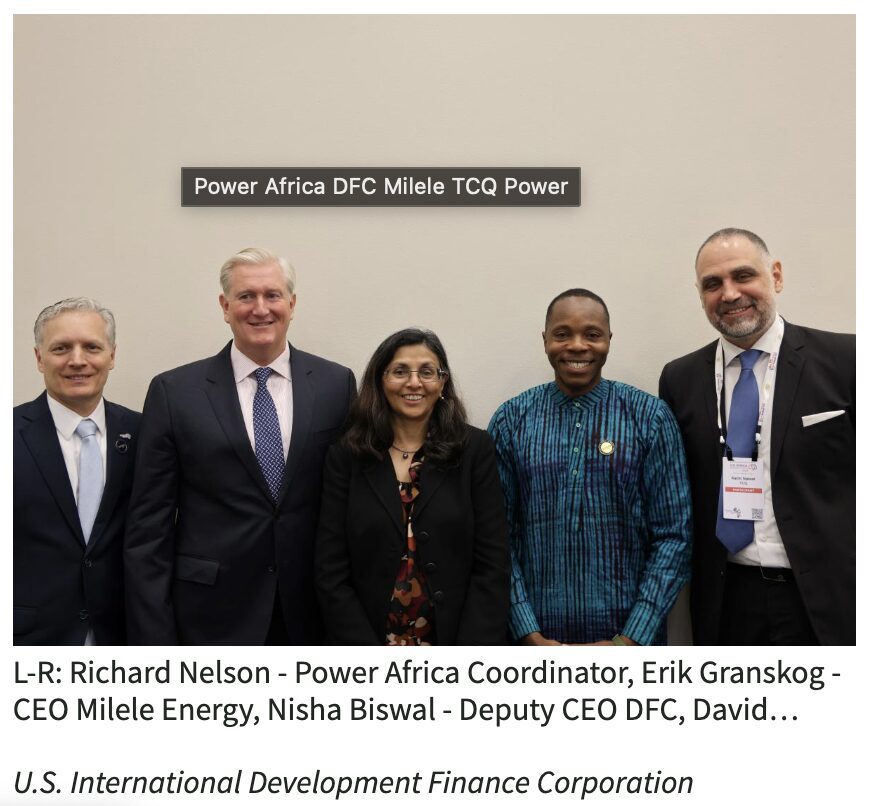

Gemcorp Capital serves as the primary financial sponsor and investor in Milele Energy, facilitating its growth as a renewable energy platform in sub-Saharan Africa. Through a $150 million seed investment, Gemcorp has supported Milele’s acquisition and development of key assets, including a stake in the Lake Turkana Wind Power Project in Kenya. As Milele’s financial backer, Gemcorp holds equity in Milele, designating it as a portfolio company within Gemcorp’s investment portfolio, but operational control remains with Milele’s management team.

However, Gemcorp’s financial support is not passive; as an investor with considerable capital at stake, Gemcorp is expected to exert strategic oversight. Despite Milele Energy’s operational team and its day-to-day autonomy, the financial and strategic backing from Gemcorp positions it effectively as a subsidiary within Gemcorp’s portfolio which is part of $7 billion in cumulative investments since its establishment in 2014.

The partnership aligns with Gemcorp’s commitment to impact-driven investment in Africa’s energy sector. Gemcorp has made a commitment to investing at least $10 billion in Africa over the coming decade reflecting its ambition to reshape energy infrastructure in emerging markets.

2. Financial Structure of the DFC Loan

The U.S. International Development Finance Corporation (DFC) approved a new loan of up to $292 million specifically for the Western Area Power Generation Project in Freetown, Sierra Leone. As a project sponsor, Milele Energy is a primary recipient of this financing. The funds are intended to help develop and upgrade the power plant’s infrastructure, which Milele Energy will own and operate. Additionally, the DFC is providing up to $120 million in political risk insurance, which protects Milele Energy’s investment against risks such as expropriation, political violence, and currency inconvertibility. This serves to make the project more attractive to additional investors and lenders, reducing the overall cost of capital and enhancing the financial stability of Milele Energy’s investment.

3. Benefits to Milele Energy and Concerns over Russian Linkage

Upon completion, the project will become Sierra Leone’s main source of power generation. As an owner and operator, Milele Energy stands to gain significant revenue from the sale of electricity over the lifespan of the power plant. The involvement of Milele Energy—a portfolio company of London-based Gemcorp Capital, with controversial historical ties to Russian interests—in a major energy project in Sierra Leone adds a layer of complexity.

4. Implications of Russian Connections

During a time when Russian entities are under heightened scrutiny and restricted in their freedom of operations within the global financial system, a capital windfall with future dividends raises immediate questions if not outright concerns. This is especially notable as it comes on the heels of a cancelled $1 billion Memorandum of Understanding (MoU) between Gemcorp and the Bulgarian Ministry of Energy less than two years earlier over the Bulgarian government’s concerns of Gemcorp’s ties to Russian interests, fueled partly by investigations by the Financial Times when deal was signed in March, 2022, [See Part I, 7].

5. Geostrategic Considerations of Russian Involvement

The interconnectedness of modern global strategies means that investments and projects in one country can have far-reaching implications. Sierra Leone’s energy projects, through companies like Milele Energy, among other notable functions, serve as vehicles for Russia to support and extend its influence to other strategic areas like Kenya, where Milele is headquartered.

Kenya is notable as a vital node in China’s Belt and Road Initiative’s maritime geo-economic corridor. The Port of Mombasa, Kenya’s largest seaport, is a key maritime hub facilitating significant trade between Africa and Asia under the BRI. This holds the potential to furnish Moscow with leverage in its dealings with Beijing and expand its global trade prospects at a time when western powers seek to contain Putin’s ambitions. Moreover, Sierra Leone’s resource-rich territory potentially provides both a domestic and regional foothold for Russian interests which extend to expanding its global economic and geopolitical footprint.

Russia, through its state-backed contractors like the Wagner Group—formerly, a private military company infamous for its deleterious involvement in Middle Eastern and African conflicts, now integrated into Russia’s Africa Corps—and strategic partnerships with China and Iran, has a history of destabilizing activities in the region, arming and training militant groups to expand its arms exports and influence through special operations and low-intensity conflicts, engaging in financial schemes to ease the pressures of western sanctions and effectively brokering influence in pursuit of its unilateral objectives.

The U.S. must carefully weigh the implications of positioning itself to inadvertently strengthen Moscow’s posture in sub-Saharan nations, and beyond, despite the nuanced benefits strategically structured geo-economic engagements, rather than purely containment approaches, may present. While its possible that a sophisticated strategy has been devised by the administration in a calculus of engagement with Russian-linked entities, the risks undermining the sanctions regime poses, and the potential to enable Moscow to prolong or otherwise oxygenate its war in Ukraine, presents a substantial set of concerns. After all, certainly on face value, bolstering Russia’s strategic positioning in Africa and other regions, runs counter to U.S. efforts to limit its geopolitical influence.

Introduction: How a U.S. Lobbyist Helped Bring Down the Bulgarian Government, Left Ukraine Vulnerable in the Lead-Up to Russia’s Invasion, and Secured $412 million in U.S. Funding for Russian Defense-Linked Firms

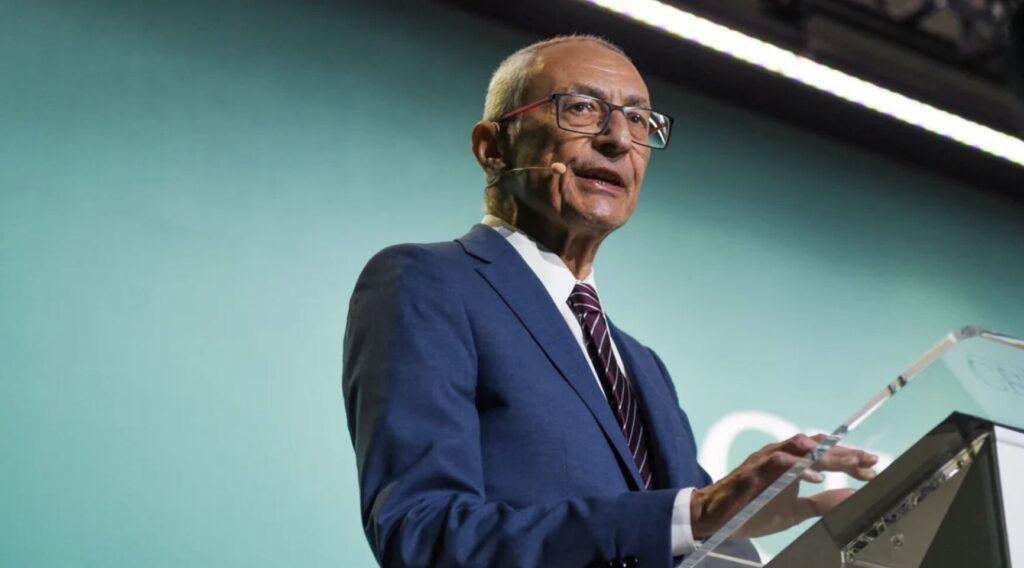

In 2024, John Podesta, in his roles as Senior Advisor to President Biden for International Climate Policy, since 2022, and the U.S. Climate Envoy since 2024, oversaw the disbursement of $412 million in U.S. funds through the Development Finance Corporation (DFC) and the United States Agency for International Development (USAID) to Gemcorp’s African subsidiary, Milele Energy, a firm tied to Russian defense interests, on the heels of lobbying efforts by his brother on the company’s behalf, which caused a political earthquake in Bulgaria, toppling the pro-Western Petkov government in the summer of 2022 and sparking investigations, with tremors still reverberating through the country’s political landscape today, [1, 2].

“Who actually brought the company to Bulgaria?” demanded Bulgarian politician and lawyer, Desislava Trifonova, in heated parliamentary hearings during July 2022. “Why did Bulgaria’s outgoing Premier lie that he had ordered a counterintelligence probe into the firm, and did he lie that the company was recommended by the United States Embassy in Sofia and the British Embassy in Sofia?” bellowed the MP amid hearings that sparked a political crisis in the former Soviet Bloc nation, strategically positioned on major historical trade routes near the Bosphorus Strait, [3].

A $1 billion investment Memorandum of Understanding (MoU) signed on March 23, 2022, between Bulgaria’s Energy Minister Alexander Nikolov, British Gemcorp Capital Management Ltd., and American IP3 Corporation was canceled only months later, triggering the series of hearings and investigations over Gemcorp’s connections to Russian state entities and Russian oligarchs, [4].

As the Gemcorp scandal unfolded in 2022—which saw John Podesta’s brother, Tony Podesta, earn $880,000 in lobbying fees and an additional $240,000 in 2023—it became clear that the legacy of an earlier scandal involving Protos Energy, its parent company INSA Oil, Tony Podesta and the Russian-backed Bulgarian oligarch, Delyan Peevski, had paved the way for heightened sensitivity to Russian capital flows used to propagate Bulgarian and Ukrainian reliance on Russian energy exports which [5, See Part II, 1]. Tony Podesta’s lobbying for these firms between 2021 and 2022 helped to entrench Ukraine’s reliance on Russian hydrocarbons in the lead-up to Russia’s invasion in February 2022. These Peevski-backed firms played a central role in maintaining the flow of Russian energy into Ukraine, despite sanctions and growing international concern, [6, 7, 8].

Collectively, the revelations fueled the political coup in Bulgaria that prompted the government to cancel its Memorandum of Understanding (MoU) with Gemcorp over questions about the fund’s independence from Russian capital, and sparked a chain of events that toppled Prime Minister Kiril Petkov’s government only six months after it had come to power, [9]. Positioned at the helm of the pro-Western “We Continue the Change” (PP) party, Petkov, who championed a strong anti-corruption agenda, found himself at the center of the political maelstrom surrounding Bulgaria’s energy sector and its entanglements with Russian financial interests, [10, 11]. In June 2022, following a no-confidence vote where 123 of 239 lawmakers voted to oust his cabinet, Petkov defiantly declared, “One day, we will have a Bulgaria without puppet masters, without the mafia—a normal European country,” squarely blaming Moscow for the political upheaval. Following the ouster he ordered the expulsion of 70 Russian diplomatic staff, ignoring diplomatic threats and ultimatums from Moscow, [12].

PART I: GEMCORP & MILELE ENERGY

1. Background: Tony Podesta’s Return to K-Street & John Podesta

Tony’s lobbying firm, the Podesta Group, had collapsed after it came under fire in 2017 as part of Special Counsel Robert Mueller’s investigation into Russian interference in the 2016 U.S. presidential election, [1]. The group’s lobbying work for a nonprofit called the European Centre for a Modern Ukraine (ECMU), which had connections to Ukraine’s former pro-Russian president, Viktor Yanukovych, and his political party, the Party of Regions, stirred considerable controversy in no small part because of his brother, John Podesta’s, role at the time as Hilary Clinton’s campaign manager, [2]. John shaped the Clinton campaign on the promise to counter Russian influence and interference in America, as his brother’s lobbying firm emerged in the crosshairs of Mueller’s investigation over potential violations of the Foreign Agents Registration Act (FARA). This scandal was only exacerbated by the Podesta Group’s lobbying between 2015-2016 on behalf of a sanctioned Russian bank, Sberbank, in the U.S as it sought to ease restrictions following Russia’s annexation of Crimea in 2014, [3, 4].

Following investigations into his foreign lobbying, Tony Podesta took a step back from the Washington scene. Though never personally charged, the fallout from his shuttered firm and damage to his reputation were severe, and he shifted his focus to art dealing during this period. By 2021, however, amid financial hardships Podesta began laying the groundwork for a return to K-Street and DC politics. Reflecting on his time away, he remarked, “I don’t want to recreate what I had, but I sort of miss working, and art alone doesn’t sustain me because I love politics” (The New York Times, 2021).

Between 2021 and 2022, Tony Podesta pocketed over half a million dollars for his lobbying efforts for INSA Oil and its subsidiary Protos Energy, coming in hot off the five-year hiatus following the scandals that led to the Podesta Group’s shuttering in 2017, [See Part II, 1]. Together, his lobbying efforts for Protos and Gemcorp netted him over $1.6 million between 2021 and 2024, with evidence suggesting unregistered lobbying for another Peevski-linked project, Hydrostroy JSC, may have brought in an additional $1.2 million since 2021, for a total potentially exceeding $2.8 million, [5].

2. John Podesta’s Role

On September 2, 2022, the White House press office revealed, “President Biden announced that John Podesta will serve as Senior Advisor to the President for Clean Energy Innovation and Implementation” (OCEII), a National Security Council cabinet-level position to lead “the Administration’s efforts to combat global climate change,” [6, 7]. A year and a half later, on March 6, 2024, John Podesta stepped up to replace John Kerry as U.S. Climate Envoy, taking on the additional role and placing him in a high-profile position within the Biden administration’s National Security Council with direct oversight over projects and the disbursement of DFC and USAID funding, [8]. By the end of the month on March 29th, 2024, Gemcorp terminated its contract with Podesta Group, marking the end of Tony Podesta’s lobbying for the company which was registered with the U.S. Senate in May 2022, [9, 10]. Nine weeks later, on May 8, 2024, Tony’s brother, John Podesta approved $412 million in DFC funding for Milele Energy, a Gemcorp portfolio investment vehicle, raising concerns about conflicts of interest and legitimate questions about implications for both regional and global geoeconomics and security dynamics, [11].

3. Legal and Ethical Concerns

Articles 502, 702 and 702(a) of §2635 of 5 C.F.R. and Executive Order 13989, Executive Order 14024, FARA 22 U.S.C. §611 et seq., and other related regulations and statutes are all potential areas of concern within the Office of the Inspector General’s (OIG) and the Department of Justice (DOJ) jurisdiction for investigations.

3.1 Article 502 of §2635, 5 C.F.R. – Personal and business relationships

Article 502 concerns “Personal and business relationships” and is structured to prevent government officials from taking official actions in situations where they or those with close personal or business connections might benefit improperly. It restricts employees from participating in matters that would directly affect their financial interests or those of a spouse, minor children, or individuals with whom they have close business ties. Given the ties between Anthony Podesta’s lobbying work and John Podesta’s role in authorizing funding for Milele Energy, any alignment of interests could warrant closer examination under this article.

Ref: 5 C.F.R. §2635.502, Personal and Business Relationships, available through the U.S. Government Publishing Office (GPO)

3.2 Articles 702 and 702(a) of §2635, 5 C.F.R. – Use of public office for endorsement or private gain

These sections outline restrictions related to “Lobbying Activities” and “Outside Activities,” focusing on preventing federal officials from engaging in actions that could be perceived as using their position to provide undue influence or private benefits. Given John Podesta’s governmental role and the $412 million in DFC funding for Milele Energy—closely following the cessation of Anthony Podesta’s lobbying engagement—this regulation is relevant to ensuring the separation of federal powers from lobbying interests. The LD-1 Disclosure Form confirms that lobbying efforts involved energy security and infrastructure, directly intersecting with John Podesta’s oversight in international climate and energy policy, inviting scrutiny for potential regulatory breaches under Article 702.

Ref: 5 C.F.R. §2635.702, Use of Public Office for Private Gain, 5 C.F.R. §2635.702(a), Endorsement, available through the GPO, available through the GPO.

3.3 Executive Order 13989 – Ethics Commitments by Executive Branch Personnel

This Executive Order, issued to “ethics pledge” employees, mandates a prohibition on participating in matters involving former employers or clients for at least two years from the date of federal appointment. For John Podesta, with jurisdiction over USAID and DFC funds, Executive Order 13989 mandates careful observance of impartiality. While this order does not directly apply to family members, the optics of his brother’s lobbying prior to funding approval remain within the OIG’s purview as an area of potential concern.

Ref: Order 13989, Ethics Commitments by Executive Branch Personnel, Federal Register, Vol. 86, No. 14 (January 20, 2021), pp. 7029–7031.

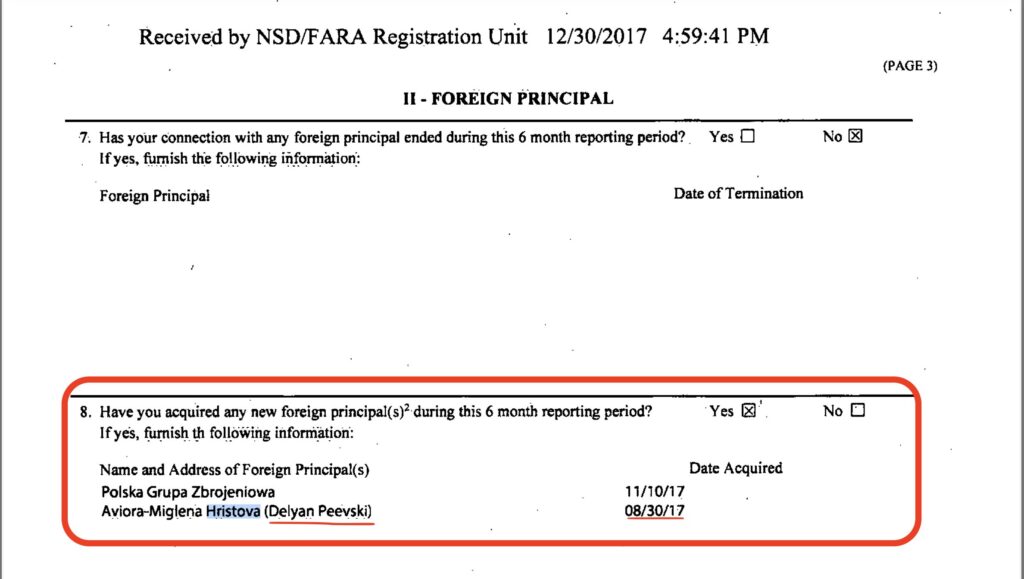

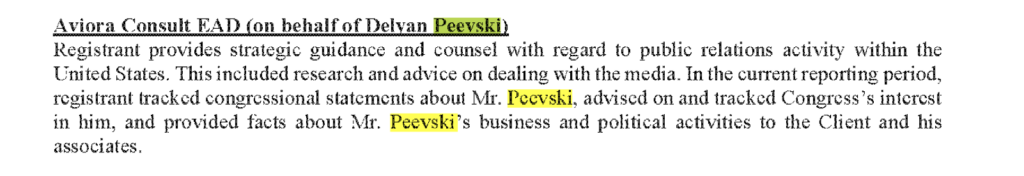

3.4 Foreign Agents Registration Act (FARA) – 22 U.S.C. §611 et seq.

FARA defines a “foreign principal” broadly, encompassing foreign-owned companies, foreign governments, political parties, and entities organized under foreign laws or significantly influenced by foreign interests. Gemcorp’s structure—headquartered in London, with opaque offshore ownership structures, and with substantial foreign investments and portfolios across multiple countries including Kenya, Russia, and other international holdings—suggests it is subject to foreign influence. If Gemcorp’s operations or decision-making are influenced by foreign persons or interests—specifically in this case those tied to Russia—this could classify it as a foreign principal under FARA. The Bulgarian government’s cancellation of the $1 billion MoU over concerns about Russian connections suggests a perception of foreign influence that could trigger FARA considerations. Despite Gemcorp’s denials of Russian ties, the Bulgarian government’s actions indicate potential credibility concerns, and this history could raise a “foreign principal” presumption under FARA for Gemcorp.

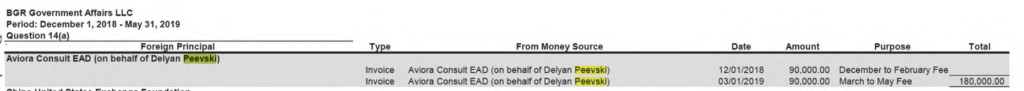

Additionally, covered in more detail in Part II, the shuttering of Podesta’s lobbying firm’s in 2017 saw an exodus of clients and lobbyists to a number of firms, notable among them, Cogent Strategies and BGR Government Affairs. The latter, BGR, lobbied on behalf of Delyan Peevski beginning in August 2017, [12, 13].

BGR, which registered under FARA to earn $30,000 a month and additional fees under the agreement, was expected to furnish Peevski with strategic guidance, media research, and tracking statements and interest levels within the U.S. Congress regarding Peevski’s business and political reputation, [14].

Notably, joint investigations by the Bureau of Investigative Reporting and Data (BIRD) and Bivol led by Bulgarian journalist, Atanas Tchobanov, claim that Podesta entered a contract worth USD 1.2 million in 2021 with Peevski-linked construction company, Hydrostroy JSC. The agreement, which ran from August 16, 2021, to August 16, 2022, with quarterly payments reportedly involved lobbying to the U.S. government without FARA registration, [15, 16].

Ref: Foreign Agents Registration Act of 1938, as amended, 22 U.S.C. §611 et seq., available at the GPO.

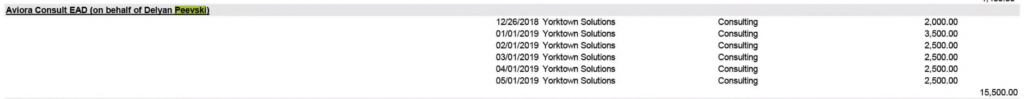

3.5 Gemcorp’s Shareholding Structure and Implications under §136 of U.K. Companies Act 2006

UK law requires companies to disclose natural persons with significant control, even if corporate entities serve as directors or shareholders. GEMCORP CAPITAL LLP’s CEO, Atanas Bostandjiev resigned from his role as LLP Member on 23 December 2021 according to public records. In fact, after the management take over with the divestment of Russian oligarch Albert Avdolyan, 28 of the 30 officers on record terminated their roles with only two remaining active. These two are corporations, GEMCORP CAPITAL (SERVICES) LIMITED (Registration number: 08869490) active since 2014, and GEMCORP COMMODITIES TRADING SERVICES (CAYMAN) LIMITED registered in the Cayman Islands (Registration number: MC-339161)and appointed on Appointed: 21 July 2023. In Gemcorp Capital’s Member’s report for 2023, filed earlier this month on 11 Oct 2024, the firm acknowledges that John Fulton was appointed on October 18, 2022, and resigned on July 21, 2023, [17, 18].

This raises potential questions about compliance with the transparency requirements under the Companies Act 2006 and the PSC regime, which could impact third-party due diligence evaluations of the DFC and USAID with respect to their loans to Gemcorp’s portfolio company, Milele Energy.

UK company law, specifically the Companies Act 2006 and the People with Significant Control (PSC) regime, mandated that companies cannot operate in a structure where there is no identifiable individual having significant control (whether directly or indirectly). Under PSC regulations every UK company must disclose individuals or legal entities that have significant control, where a PSC is someone who:

• Owns more than 25% of the company's shares.

• Holds more than 25% of the company's voting rights.

• Has the power to appoint or remove the majority of the board of directors.

• Otherwise exercises significant influence or control over the company.Companies can be directors (corporate directors), but at least one natural person must be registered as a director of the company. As of 2008, UK law requires at least one individual director, making it impossible to have a structure where all directors are corporate entities without any individuals. Circular or cross-shareholding structures (where Company A controls Company B, Company B controls Company C, and Company C controls Company A) can be structured, but it doesn’t eliminate the requirement for identifiable PSCs or natural persons. The PSC regime requires transparency at all levels, so the chain of ownership or control must ultimately lead to an individual or group of individuals, [20, 21, 22].

3.6 Strategic Timing of Disengagement

The timing of Anthony Podesta’s termination of his lobbying agreement with Gemcorp is notably relevant, especially as it occurred approximately one month before his brother approved substantial funding for Gemcorp’s portfolio company, Milele Energy. This sequence raises questions about the timing of the termination, which could suggest an effort to mitigate any appearance of a conflict, although it does not necessarily eliminate concerns of indirect influence. A closer review by OIG might assess whether the termination was strategically planned to precede the funding approval, reducing regulatory and ethical concerns.

3.7 Lobbying Efforts Directed at Government Representatives

The LD-1 form shows Tony Podesta’s lobbying activities were directed toward government representatives within Congress rather than USAID or DFC directly. While indirect lobbying might seem less potent, it could still influence outcomes, especially given John Podesta’s ultimate authority over DFC funding approvals for energy projects. This indirect approach, by targeting policymakers potentially influencing USAID and DFC’s decision-making frameworks, does not in itself eliminate conflict but rather shifts the scope of influence, requiring a broader view of regulatory reach and potential ethical implications under Articles 702 and 702(a).

Ref: Lobbying Disclosure Act of 1995, 2 U.S.C. §1601 et seq., available at the U.S. House of Representatives Office of the Law Revision Counsel or GPO.

This combination of Gemcorp’s potentially problematic structure under U.K. laws, sequential lobbying termination, John Podesta’s role, and the direct lobbying of legislative representatives indirectly related to DFC and USAID underscores a need for thorough oversight under 5 C.F.R. §2635 and other relevant statutes as deemed appropriate by authorized bodies.

4. Overview of Gemcorp’s Ties to the Kremlin

Among Gemcorp’s ties to the Kremlin, two early investors with connections to Vladimir Putin and the Russian defense conglomerate Rostec; the founder’s affiliations with Russian banks and financial links to Kremlin-backed Bulgarian crime syndicates; his thwarted arms export deal in 2018 with a sanctioned Rostec subsidiary in Angola; and financial involvement with a sanctioned Russian state bank directly tied to the Troika Laundromat laundering scheme—have all stirred considerable controversy.

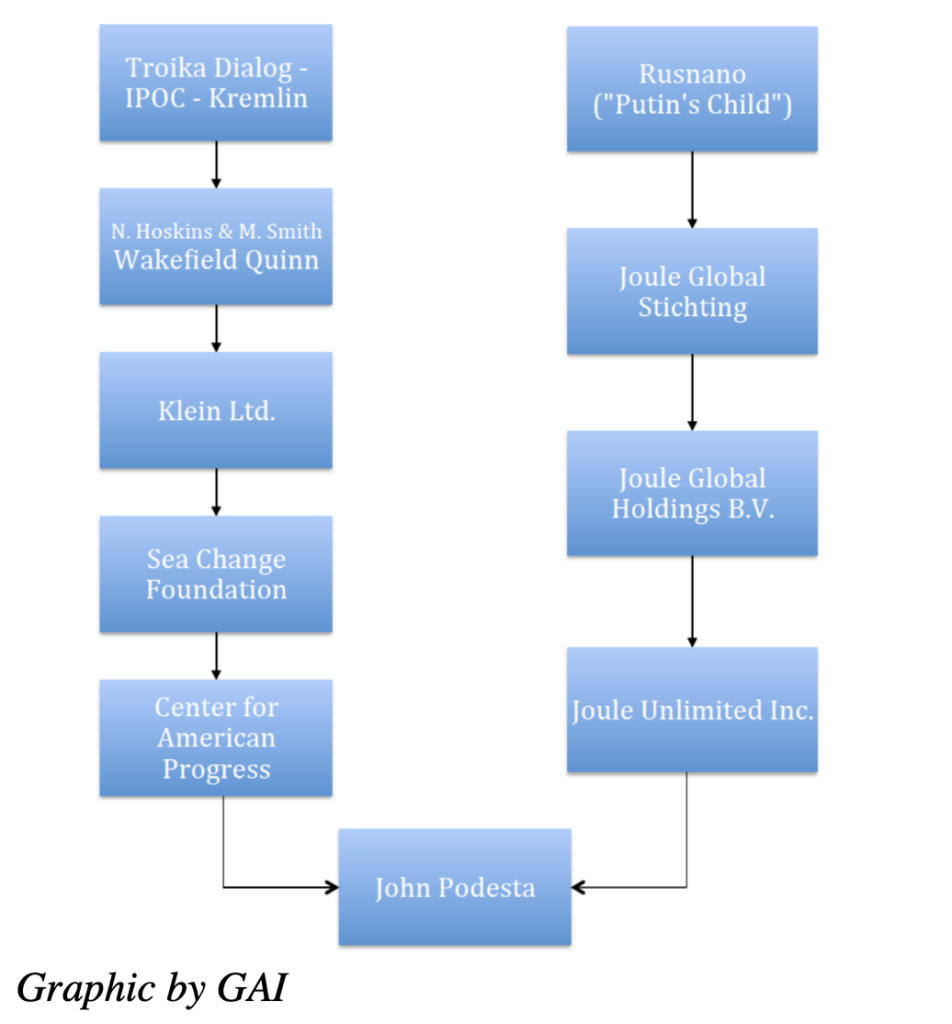

4.1 Concerns Over the Podesta Brothers and Russian Influence

Given sanctioned Russian Sberbank’s role in funding Gemcorp, for which Tony had lobbied, and its connection to Troika Dialog, embroiled in the largest money laundering scheme in financial history, and Sberbank figures who were financially involved with John Podesta during his time at Joule Unlimited between 2011 and 2014, a host of entanglements complicate the ethical landscape surrounding both John and Anthony (Tony) Podesta’s involvement with Russian-linked entities, as detailed in what follows.

4.2 Gemcorp’s Early Investors: Albert Avdolyan and Sergey Adoniev

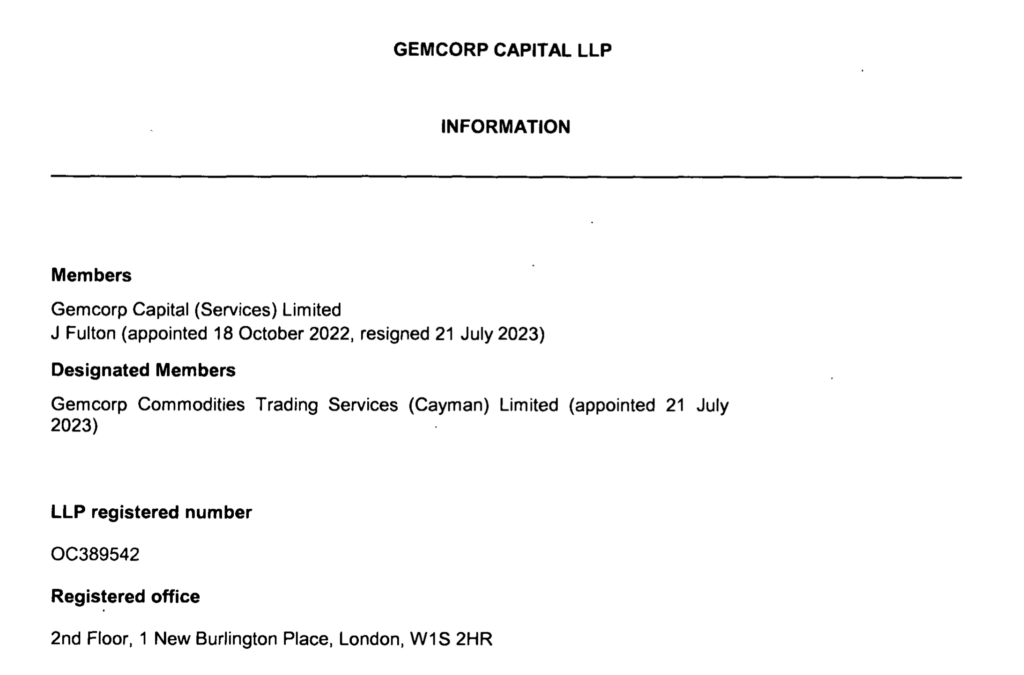

Gemcorp, a London-based fund, had two key early investors with deep ties to Russia: Albert Avdolyan and Sergey Adoniev. Both Russian oligarchs, with close ties to Vladimir Putin and Rostec’s head, Sergey Chemezov, invested heavily in Gemcorp through telecom deals backed by Russia’s defense conglomerate, Rostec, funding Gemcorp’s founder, Atanas Bostandzshiev, with $250 million in seed money, [23].

Sergey Adoniev: Russian-Israeli Sergey Adoniev, provided a significant portion of Gemcorp’s early financial backing but he divested from the company in 2015 due to mounting concerns over to his deep connections to Russia’s defense sector and the broader Russian oligarchy, [24]. He had his Bulgarian citizenship revoked in January 2019 after undisclosed criminal convictions in Russia came to light and a government review found Adoniev had failed to disclose a prior conviction for smuggling electronics in the 1990s, [25]. He was subsequently sanctioned by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) under Executive Order 14024 on January 26, 2023, which targets individuals and entities connected to Russian malign activities, as part of the broader sanctions against Russian individuals and entities following Russia’s invasion of Ukraine, [26, 27]. His alleged involvement in corruption and ties to illicit financial activities linked to the Kremlin, as well as his position as a known financier to Russian President Vladimir Putin and Sergei Chemezov, who heads the state-owned defense firm Rostec led to the designation.

When the OFAC listing was announced on January 26, 2023, U.S. Secretary of State Antony J. Blinken emphasized the broader objectives behind the new sanctions list, stating, “This action supports our goal to degrade Moscow’s capacity to wage war against Ukraine, to promote accountability for those responsible for Russia’s war of aggression and associated abuses, and to place further pressure on Russia’s defense sector,” [Ibid.].

Albert Avdolyan: The other early investor in Gemcorp, Albert Avdolyan, known to have made his fortune selling telecoms backed by Russia’s defense conglomerate Rostec, is a Russian oligarch with close ties to Vladimir Putin and a self-proclaimed childhood friend of Sergey Chemezov, the head of Rostec. Avdolyan formally divested from Gemcorp in 2020, but concerns over his influence in the firm persisted. A Dossier Center report revealed earlier this year that Gemcorp, despite Albert Avdolyan’s 2020 divestment, continued operating from their office, located in Moscow-City’s Empire Tower, under Avdolyan’s family holdings until late 2021. Gemcorp’s extended presence, with no formal leasing agreement in place, suggests residual ties between Avdolyan and Gemcorp, and has raised red flags over the firms lingering ties with Russian interests, [30].

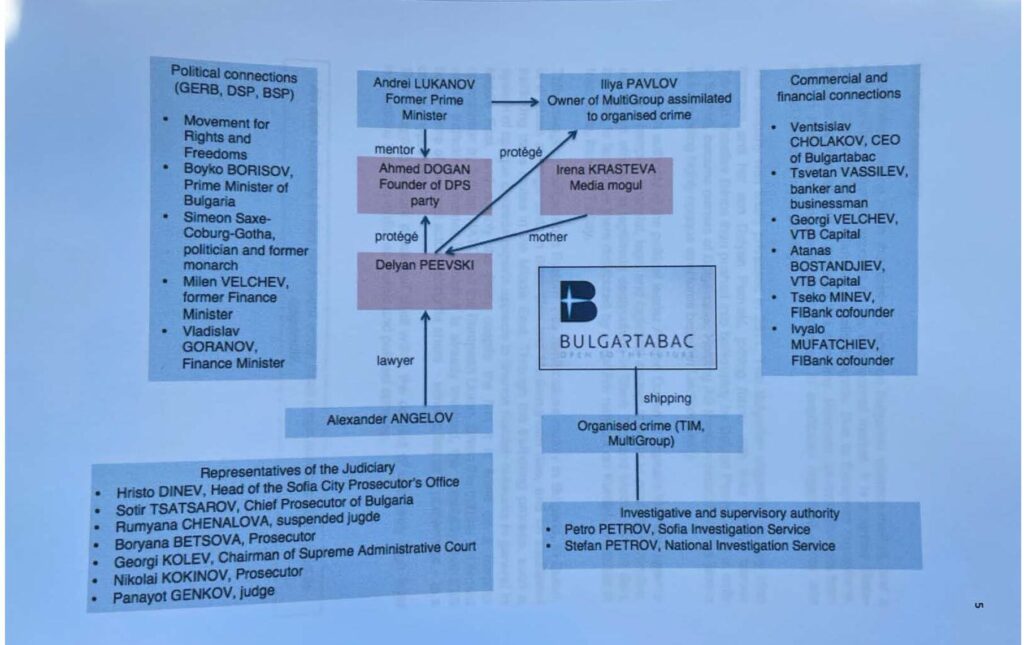

4.3 Gemcorp’s Co-Founder and CEO, Atanas Bostandjiev

Gemcorp’s founder, Atanas Bostandjiev, had links to Russia through his role as the director of the London branch of VTB Capital, a Russian owned bank that was involved during his tenure in several deals in Bulgaria, including some tied to a highly controversial Russian-backed Bulgarian oligarch, Delyan Peevski, well-known for his influence in the Bulgarian political system, his manipulation of state assets, and his involvement in the country’s crime syndicates, [31]. Peevski was strongly implicated in transnational crime activities backed by the Kremlin, including illicit trade and money laundering schemes that were utilized to fund designated terrorist organizations in Iraq, Syria, Iran and Turkey, [32].

In July 2014, Atanas Bostandjiev resigned from a failing VTB Capital after stepping up to the role of Head of International Business in May 2011, where he had been tasked with growing the firm’s international business portfolios with a focus on emerging markets in Central and Eastern Europe, Africa, and the Middle East. Under his leadership, VTB Capital’s international division was unprofitable, and by 2013, the London office of VTB Capital, which he managed, saw a dramatic collapse in revenues. In response to his division’s performance issues, Bostandjiev’s suggested reducing the number of clients and cutting staff. However, profits continued to decline, with a key asset collapsing catastrophically leading to his departure.

A core controversy during his tenure centers around VTB’s involvement with the Corporate Commercial Bank (KTB) in Bulgaria, in which VTB owned a 9% stake, and which subsequently went bankrupt. In June 2014, a month before Bostandzshiev’s departure from VTB Capital, KTB collapsed after a bank run, with massive withdrawals leading to its insolvency. The Bulgarian National Bank placed KTB under special supervision, and the bank’s license was officially revoked in November 2014. KTB’s failure was one of the largest financial scandals in Bulgaria, involving allegations of fraud, mismanagement, and corruption, [33].

Depositors were insured up to a certain amount, with many individuals and businesses recovering only a fraction of non-guaranteed funds. The Deposit Guarantee Fund (FGVB) had to borrow from the government to cover insured deposits, creating long-term debts. Its collapse triggered a series of legal disputes and investigations into its operations, including connections to Bulgarian oligarchs and high-profile business figures such as Tsvetan Vasilev, the bank’s main shareholder.

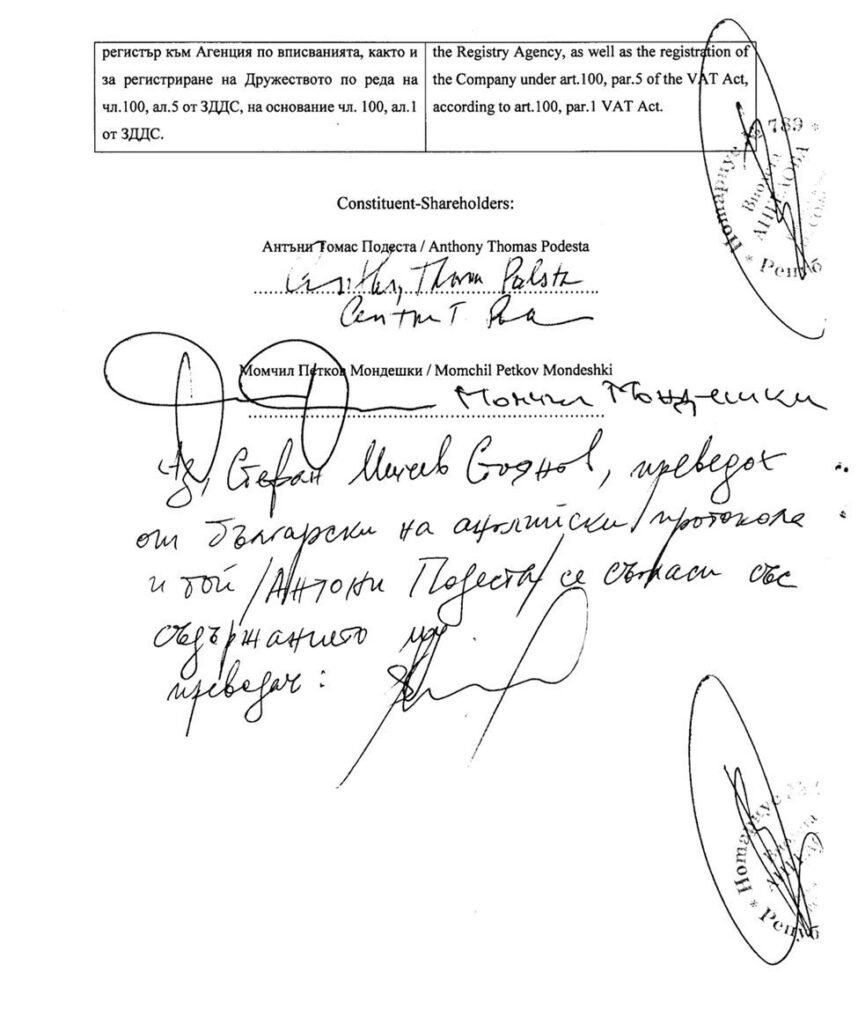

Notably, Momchil Mondeshki, a Bulgarian lawyer who was a key player in the legal battles that followed the bank’s collapse, specifically in relation to how the bank’s assets were managed and distributed during liquidation, would later register as a partner of Tony Podesta in a Bulgarian consulting firm, in November of 2021. This is important, as in the midst of this banking scandal Mondeshki became known for his connection to Delyan Peevski, who benefited from KTB’s collapse, gaining control over some of its valuable assets.

As VTB attempted to distance itself from the failure, it emerged that Bostandjiev had resisted attempts to rescue the bank. But in the wake of KTB’s collapse, Bostandjiev and VTB’s role in Bulgaria’s financial sector came under heavy scrutiny.

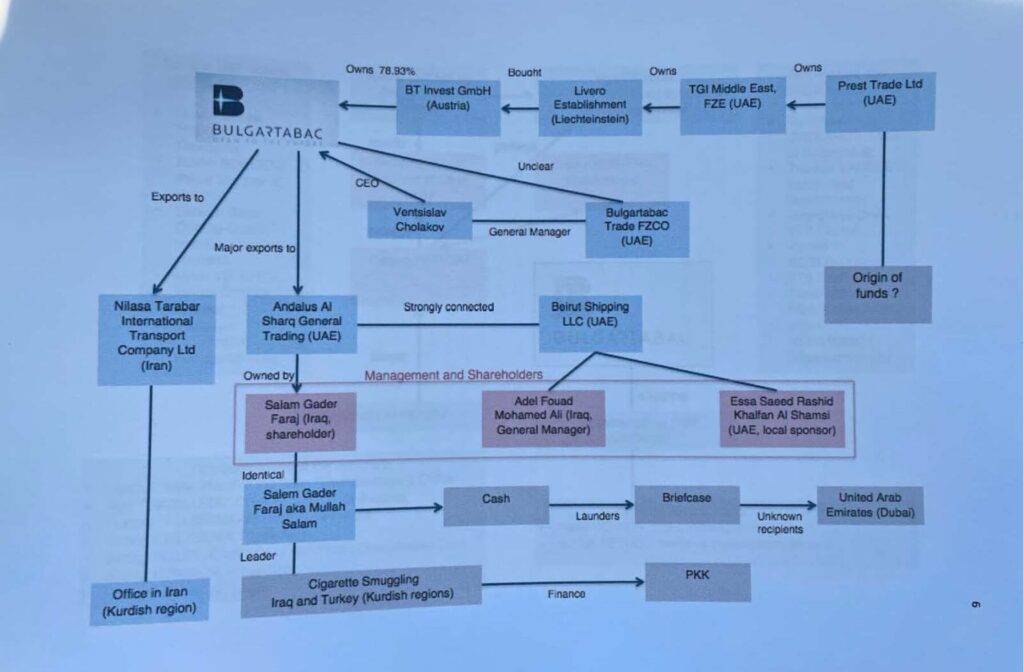

Bostandjiev’s time at VTB’s helm directing international investment saw several concerning acquisitions in Bulgaria, including stakes in Bulgartabac and Vivacom, through partnerships with local figures Tsvetan Vasilev, the main shareholder of KTB, and Delyan Peevski, both of whom were connected to the Bulgarian mob and backed by the Kremlin in illicit trade and money laundering schemes. In 2017 Turkish Authorities, and later Bivol and BIRD (Bureau for Investigative Reporting and Data), both Bulgarian investigative journalism platforms, unraveled legitimate concerns over Russian funding of designated terrorist networks in the Middle East and North Africa through these schemes, [34].

(Pictured: Bulgartabac and illicit trade: Synthesis report on the “Bulgartabac system”. Bivol p. 5)

Bulgartabac was once a state monopoly in Bulgaria’s tobacco industry but was privatized in 2011. VTB Capital, at the time a Russian state-controlled entity, was involved in the acquisition and privatization of Bulgartabac. In the wake of KTB’s collapse the company became controlled by Bulgarian oligarchs, including Delyan Peevski, his mother Irena Krasteva, and banker Tsvetan Vassilev through opaque entities based in Liechtenstein, [35, 36]. In his capacity as head of VBT Capital’s international investments Bostandzschiev oversaw the financing arrangements that enabled these acquisitions, which sparked a maelstrom of allegations over shady dealings.

Peevski’s mother, was a well-known figure with connections to Bulgaria’s media and political landscapes. She was a former head of the Bulgarian Sports Totalizator (the national lottery) and became a prominent media mogul, acquiring several Bulgarian newspapers and TV stations. Krasteva has been linked to organized crime circles in Bulgaria, and her media empire was seen as a tool for shaping public opinion in favor of specific political and business interests, including those of her son, [37]. On June 14, 2013, he would be controversially appointed as the head of Bulgaria’s State Agency for National Security (DANS) sparking widespread protests and outrage due to his political and business ties, and his involvement in controversial dealings, media monopolization and alleged corruption. Matthias , the German ambassador in Bulgaria, and his French counterpart, Philippe Autie, publicly decried the “crisis of confidence in the management of the country” following the appointment of Delyan Peevski as the head of DANS by the Bulgarian Parliament over his links to syndicated crime, [38]. The public backlash led to his resignation just one day later, on June 15, 2013.

They would be proven right as Bulgartabac’s cigarettes, often referred to as “cheap whites” which were legally shipped to countries around the Black Sea and Mediterranean, were revealed by Turkish authorities in November 2017 to have then been smuggled, beginning in 2011 with the company’s privatization with VTB’s support, into Kurdish regions in Iraq, Syria, Iran, and Turkey. The formal investigation led to a report being sent to Interpol alleging that the company was involved in smuggling operations to finance terrorism, with credible information linking these operations to the financing of the PKK and other designated FTOs, likely Al Qaeda and ISIS among them, [39].

In 2015, Vivacom was sold at a controversially low price to a consortium led by an associate of Peevski, Spas Roussev, amid allegations of corruption, insider dealing, and undervaluation. It was then revealed that KTB, the bank controlled by Tsvetan Vasilev, had heavily financed Vivacom during Bostandzshiev’s tenure at VTB when it owned 9% of KTB. As Frances Coppola noted in her November 2014 FORBES article, “It was Krasteva’s son Peevski who started the run on KTB that forced its closure in June 2014, only three months after Vassilev put together the self-funding scheme to shore up the bank’s capital,” [40].

When KTB collapsed, Vivacom’s assets had become entangled in complex legal disputes involving Russian financiers and Bulgarian oligarchs, raising concerns about the legitimacy of the sale and control over the telecom giant. In 2021, The Pandora Papers revealed details about oligarch Delyan Peevski and his network in Vivacom’s subsequent acquisition by Peevski-linked entities, further consolidating his grip on Bulgarian media and telecoms. Peevski’s control over Bulgarian media channels led to widespread allegations that they were used to suppress investigations into Bulgartabac and Vivacom.

Subsequently, in 2018 the Center for Media, Data and Society (CMDS), a research center for the study of media, communication, and information policy and its impact on society and practice published a detailed report noting that:

“Delyan Peevski, an MP from the Movement for Rights and Freedoms (DPS) and a media mogul whose New Bulgaria Media Group (co-owned and run jointly by his mother Irena Krasteva and himself) owns six newspapers and controls 80% of the print media distribution market, is also actively lobbying media regulators, mainly through his MP position,” [41, 42]. The impact of Peevski’s consolidation over media outlets has been deleterious to journalism in Bulgaria, something that has been a thematic complaint by numerous policy research institutes. For instance Reporters without Borders (RSF) notes that “investigative journalists are often subject to various types of pressure: from warnings, intimidation, “Sicilian” messages and defamatory campaigns to physical assaults on them and their property,” laying the blame squarely at the feet of Delyan Peevski for its 111th ranking of Bulgaria out of 180 members in its World Press Freedom Index: the lowest ranking of any European Union member, [43, 44].

Following KTB’s bank run and his departure from VTB Capital in 2014, Gemcorp was the immediate next step for Atanas Bostandjiev, co-founding the venture with Albert Avdolyan, which sparked a legal dispute with VTB. VTB accused Bostandjiev of violating non-compete clauses, poaching clients, and using confidential information to set up his new venture just weeks after leaving the Russian bank in disarray. On July 16 bank is sanctioned under Executive Order 13662, restricting

In Bostandjiev’s initial role at Gemcorp as the CEO and co-founder he oversaw the firm’s focus on investments in emerging markets in Africa and Eastern Europe. The company’s financing operations and investments were heavily scrutinized due its backing from Russian seed capital, linked to Russian state funding and the Kremlin’s defense sector. When Avdolyan formally divested in 2020, Bostandjiev claims to have led a management buyout, with Gemcorp’s site indicating that he took full ownership of the company alongside his leadership team in 2021.

During Bulgaria’s 2022 Gemcorp scandal the following year, Atanas Bostandjiev’s involvement, was only worsened by revelations that in 2018, as detailed in a joint investigation by the Dossier Center and Financial Times, Bostandjiev, met with Alexander Mikheev, CEO of Rosoboronexport (a sanctioned subsidiary of Rostec), in Angola to discuss a potential arms deal, [45]. This was part of broader Russian efforts to expand arms sales to African nations following the 2014 annexation of Crimea and the imposition of Western sanctions.

Although Gemcorp acknowledged these meetings, it claimed to have refrained from the deal to avoid violating U.S. sanctions that had been in place against Rosoboronexport since 2015. Despite these assertions, ties between Gemcorp and Russian interests, including Albert Avdolyan considerable holdings at the time—given his strong connections with the head of Rostec, Sergey Chemezov and direct ties to Vladmir Putin—continued to raise concerns, [Ibid.].

4.4 Sberbank, Ruben Vardanyan, and the Troika Laundromat

Sberbank, a sanctioned Russian state-controlled bank with ties to the largest money laundering scheme in financial history, dubbed the Troika Laundromat, and its much-publicized ties to Gemcorp compounded the controversy.

Sberbank was renamed after its absorption of Troika Dialog, a Russian investment bank co-founded by oligarch Ruben Vardanyan, who is closely associated with the Kremlin and was hand selected by Vladmir Putin as an appointee on Russia’s economic modernization council. Vardanyan was later uncovered as the central figure and architect of the largest money laundering scheme in history, involving $4.6 billion in fund flows, dispersed across 1.3 million transactions through 75 offshore entities to 236,000 companies across the global financial system. The scandal, which became known as the Troika Laundromat spanned from 2006 to 2013 and was the center of the Organized Crime and Corruption Reporting Project (OCCRP) investigations, [46].

Notably, John Podesta served on the board of Joule Unlimited, a privately-held alternative energy company funded by Russian investments, alongside Ruben Vardanyan, head of Troika Dialog, from 2011 to 2014, [47]. During Podesta’s tenure, Russian state-owned venture capital firm, Rusnano, invested $35 million into Joule Unlimited. Rusnano was led by Anatoly Chubais, whose investments frequently aligned with Russian state interests, [48, 49]. Though Podesta resigned in 2014, as Western-Russian tensions mounted over Crimea’s referendum, he divested his shares to his daughter and, as leaked emails revealed, remained involved with Joule, [50, 51, 52].

This is further complicated by Anthony Podesta’s lobbying for Vardanyan via Troika Dialog and Sberbank in 2015 and 2016. During this period, Tony Podesta received $170,000 for lobbying as Sberbank sought relief from U.S. sanctions imposed under Executive Order 13660, which restricted its access to the U.S. financial system and imposed other penalties in response to Russia’s actions in Crimea, [53]. These overlaps and proximity of interests raised concerns given the close financial ties between Sberbank, Troika Dialog, and the entities John Podesta had been involved with during his tenure at Joule, at a time when John Podesta had become the chairman of Hillary Clinton’s presidential campaign, [54].

Between 2015 and 2016, John Podesta played a key role in crafting Hillary Clinton’s campaign strategy, including its focus on energy policy and U.S.-Russia relations. Clinton’s platform was shaped by opposition to Russian influence in America, and would become increasingly vocal about Russian interference in the election, which has raised poignant questions about her campaign manager, John Podesta’s, role in Joule Unlimited and this nexus of Russian interests, [55].

In 2019, Sberbank had partnered with Gemcorp, alongside two Russian state entities, VEB.RF and the Russian Export Center, to establish a $5 billion trade finance mechanism. This initiative was designed to facilitate Russian exports to African nations, focusing on sectors such as agriculture, fertilizers, and medical products. Publicized at the Russia-Africa Summit in Sochi, this high-profile partnership underscored Russia’s broader strategy of increasing trade and political ties with countries like Angola, Ethiopia, Mozambique, and Zimbabwe.

In 2020, Rusnano and the Skolkovo Foundation were placed under the management of VEB.RF, a state-owned Russian development bank. This was part of a broader consolidation of key Russian innovation and development institutions, bringing them directly under state control. VEB.RF had previously collaborated with Sberbank on major Russian state-backed projects, further entrenching control over sectors like nanotechnology and energy. This move tied past investments, such as Rusnano’s involvement in Joule, to a larger apparatus controlled by the Russian, [56].

In sum, although its early investors, such as Albert Avdolyan, had formally divested from Gemcorp by 2020, concerns over his continued influence lingered, while questions about its founder, Atanas Bostandjiev’s ties to the Kremlin’s financial architecture, his involvement with Kremlin-backed transnational crime syndicates, his unraveled arms exports deal in Angola and the company’s strong financial relationship with Sberbank remained central to the political maelstrom that rocked Bulgaria during 2022.

Gemcorp Capital CEO Interview on Milele Investment CNBC Africa. (2023, May 4). Gemcorp Capital’s CEO discusses $150M investment in Milele Energy [Video]. Video source: https://www.cnbcafrica.com/media/6326753162112/

PART II: PROTOS ENERGY & INSA OIL

1. Russia’s Shaping Operations

Anthony Podesta Lobbied the U.S. State Department in Support of Russian Efforts to Undermine Ukraine’s Energy Independence (2021-2022) Before the February 2022 Invasion; Implicated in Money Laundering for Russia-Linked Bulgarian Oligarch Delyan Peevski.

It’s important to understand that the Bulgarian government had barely recovered from the fallout of an earlier scandal involving Protos Energy, Tony Podesta and the omnipresent Russian-backed Bulgarian oligarch, Delyan Peevski, when revelations of Gemcorp’s financial ties to Russian state-linked entities erupted into the public eye.

Podesta pocketed over half a million dollars for his lobbying efforts for INSA Oil and its subsidiary Protos Energy, coming in hot from a five year hiatus following scandals that led to the Podesta Group’s shuttering in 2017, [1]. On July 13, 2021 Anthony Podesta signed lobbying deals that would net him over $500,000 between 2021-2022, with Bulgarian company, Protos Energy, and its parent company INSA Oil; owned by Georgi Samuilov, a frontman for Bulgarian oligarch Delyan Peevski, who had been sanctioned under the Magnitsky Act just six weeks earlier, [2].

On June 2, 2021, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Delyan Slavchev Peevski, for “significant corruption” under the Global Magnitsky Human Rights Accountability Act for his extensive role in corruption in Bulgaria. Peevski and six entities linked to him were targeted by the U.S. Treasury in efforts to curb Peevski’s influence, which extended into various sectors in Bulgaria, utilizing bribes and influence-peddling to control key institutions, corrupting the political process, and benefiting financially, [3].

Peevski has been involved in industries that have historically strong links to Russian business interests, in the energy, finance, and media sectors. Russia has long maintained an influence footprint in Bulgaria’s energy sector through hydrocarbon supply chains and nuclear energy projects. Bulgaria imported Russian oil into the Lukoil Neftochim Burgas where fuel was produced, which INSA Oil and other companies then used for exports, allowing Russian oil to enter Ukraine despite EU sanctions. Thus, INSA Oil was used as a vehicle to import Russian Oil to Bulgaria via Lukoil, and then sell to Ukraine.

In 2022, Bulgaria emerged as the second-largest exporter of oil to Ukraine, accounting for 11.4% of Ukraine’s oil imports, placing Bulgaria right behind Poland as a crucial oil supplier to Ukraine, in its contribution to Ukraine’s total oil imports valued at $877 million. INSA Oil’s revenues jumped by 109% in 2022.

Bulgaria received a two-year waiver from the EU’s Russian oil import ban, which allowed the continued import of Russian oil. This loophole enabled Bulgaria to refine and export Russian oil products to Ukraine, including through companies like INSA Oil. The sanctions evasion scheme netted Russia a billion-euro capital windfall, according to POLITICO [4].

In December 2023, Bulgaria decided to scrap an EU sanctions exemption six months early, which had allowed this Russian oil to be refined and exported through Bulgaria, generating around €983 million for the Kremlin and almost €500 million in profits for Lukoil. Over the summer of 2024, Ukraine barred Lukoil products from crossing its borders which INSA Oil and its subsidiary Protos Energy relied on for its exports to Ukraine.

Russia stood to gain from Ukraine’s energy dependence. Before the war, Russia used its energy resources as leverage, exerting economic and political influence over Ukraine; a strategy that allowed Russia to impact Ukraine’s foreign policy decisions and maintain a foothold in the region. By controlling Ukraine’s energy supplies, Russia created vulnerabilities that it sought to leverage in compelling Ukraine to make concessions.

2. Podesta-Peevski Deep Ties

In November 2021, Anthony (Tony) Podesta officially partnered in a registered consulting business in Bulgaria with lawyer Momchil Mondeshki, who had been revealed in wiretap evidence to belong to Peevski’s trusted circle years earlier.

In 2015 Mondeshki became infamous through the “Yaneva Gate” recordings, in which he discussed power-broker schemes (with judges Vladimira Yaneva and Rumyana Chenalova). These secretly recorded and leaked conversations revealed Mondeshki’s close connection to Peevski, with some sources referring to him as “Peevski’s Trojan horse” due to his role in the liquidation of the assets of the collapsed Corporate Commercial Bank (KTB).

A month before Podesta and Mondeshki formed the partnership, Tony Podesta held direct meetings with Peevski in Dubai. The meeting which took place at the Bulgari Hotel on September 30 and October 1, 2021 was reportedly monitored by Bulgarian intelligence and “partner services,” according to a Bureau for Investigative Reporting and Data (BIRD) investigation, indicating that intelligence or surveillance agencies were aware of the gathering and intelligence-sharing between countries took place due to its geopolitical significance.

The BIRD investigation, conducted jointly under the network of the Organized Crime and Corruption Reporting Project (OCCRP) revealed that during the Podesta-Peevski Dubai meeting, high-profile figures close to Delyan Peevski were present, including Peevski himself, his lawyer Alexander Angelov, Georgi Samuilov (the registered owner of Protos Energy and INSA Oil), and Stefan Stoyanov, an art dealer with a controversial background and connections to Peevski’s network.

This investigation also revealed that Podesta discussed laundering of Peevski’s money through the consulting firm he would soon after create with Mondeshki in Bulgaria.

Two weeks earlier, on August 16, 2021 Podesta had signed a contract with Hydrostroy JSC, a company linked to Peevski. controlled by Veliko Zhelev, for $1.2 million. This contract also mentioned lobbying for U.S. government interests but was not listed in FARA or Senate databases. Hydrostroy has historical connections to Peevski, specifically through its acquisition of Vodstroy 98, allegedly controlled by Peevski at the time.

Shortly after the Dubai trip where he met with Peevski, Anthony Podesta celebrated his birthday in Sofia, Bulgaria in October 2021, where Stefan Stoyanov, Peevski’s art dealer, was present. Stoyanov’s Presence at these gatherings signals that Podesta was not just interacting with Peevski’s business representatives, but also with those involved in his personal financial network, which extends into luxury markets—a common tactic for sanctioned individuals to manage assets, [5].

Photo by: Politico / BIRD.bg)

Protos and INSA Oil owner, Georgi Samuilov, for whom Tony Podesta lobbied the U.S. State Department previously worked for the Multigroup conglomerate, which was described in U.S. diplomatic cables as the “doyen of Bulgarian organized crime.” According to U.S. State Department diplomatic cables from 2005, entities associated with Peevski and other Bulgarian oligarchs were known even back then for being deeply embedded in organized crime, money laundering, and corruption, [6].

3. Potential Legal and Ethical Implications

The fact that Podesta lobbied for Protos Energy and INSA Oil, whose owner Georgi Samuilov has been strongly linked to Peevski, in conjunction with the series of meetings with Peevski and his network, raises serious questions about the ethics and legality of these lobbying efforts, especially when viewed within the broader context of Peevski’s sanctioned status and the backdrop of Russian aggression in Ukraine. This link to transnational organized crime coupled with allegations by the Turkish government and investigations by Interpol into terror funding networks raises additional concerns about the ethics of Tony Podesta’s lobbying, the broader nature of Protos Energy’s operations and their alignment with malign actors’ strategic objectives, exacerbated by a pattern of lobbying efforts within the U.S.

After Anthony Podesta ignored requests for comment from Bulgarian investigative media outlet Bivol, which revealed Anthony Podesta’s involvement with companies and individuals linked to Bulgarian oligarch Delyan Peevski, in January 2022, on January 8, 2022, Tchobanov was warned by the U.S. Embassy in Sofia of a “credible” threat against him. Tchobanov detailed the call to The New American, [7]. The threat was presumed to be an assassination attempt due to his investigation into Podesta’s lobbying activities. The embassy was obliged by U.S. law to inform him about the threat since it involved serious harm. Bulgarian authorities began an investigation into the threat after Tchobanov alerted them. Although few details were provided, it was suspected that the threat originated from high-level political figures within Bulgaria, specifically associated with Delyan Peevsk.

Structured Timeline

2005

• 2005: U.S. diplomatic cables describe entities associated with Bulgarian oligarchs like Delyan Peevski as deeply embedded in organized crime, money laundering, and corruption.

2006 – 2013

• 2006 – 2013: Troika Dialog’s money laundering scheme, known as the Troika Laundromat, operates under Ruben Vardanyan’s orchestration, funneling $4.6 billion through offshore companies.

2011

• 2011: John Podesta joins the board of Joule Unlimited, an alternative energy company with significant Russian investments, including $35 million from Rusnano, a Kremlin-backed investment firm.

2013

• June 14, 2013: Bulgarian oligarch Delyan Peevski is appointed head of Bulgaria’s State Agency for National Security (DANS), leading to public protests.

• June 15, 2013: Peevski resigns from his DANS position amid public backlash.

2014

• January 2014: John Podesta resigns from Joule Unlimited, citing Russia’s annexation of Crimea, though he retains ties by transferring shares to his daughter.

• March 18, 2014: Russia formally annexed Crimea following a disputed referendum held on March 16, 2014, where Crimean authorities claimed a majority voted to join Russia.

• March 20, 2014: Executive Order 13662 is signed by President Barack Obama expanding U.S. sanctions in response to Russia’s actions in Ukraine, specifically targeting sectors of the Russian economy, including finance, energy, and defense, to address the situation following Russia’s annexation of Crimea.

• June 2014: Bulgaria’s Corporate Commercial Bank (KTB) collapses in a bank run; VTB Capital (where Gemcorp’s founder Atanas Bostandjiev had worked) held a 9% stake in KTB.

• July 29, 2014: VTB and Sberbank were added to the U.S. Department of the Treasury’s Sectoral Sanctions Identifications (SSI) List under Directive 1 of E.O. 13662, restricted U.S. persons from dealing in new debt of specific maturities issued by these banks but did not block all transactions or freeze their assets outright.

• July, 2014: Gemcorp is founded by Atanas Bostandjiev, with $250 million in seed money from Albert Avdolyan and Sergey Adoniev.

• November 2014: The Bulgarian National Bank revokes KTB’s license due to insolvency, leading to major corruption investigations.

2015 – 2017

• 2015: Tony Podesta’s Podesta Group lobbies for Russian bank Sberbank, seeking relief from U.S. sanctions.

• 2015: Gemcorp investor Sergey Adoniev divests his interests, though concerns about his influence persist.

• November 2015 – September 2016: Tony Podesta’s Podesta Group receives $170,000 from Sberbank to lobby for sanction relief related to Russia’s actions in Crimea.

• November 2017: Turkish authorities report Bulgartabac’s involvement in cigarette smuggling linked to terrorist financing. Bulgartabac, previously acquired by Peevski with VTB’s backing, allegedly smuggled products through Kurdish regions in the Middle East.

2018 – 2019

• 2018: Atanas Bostandjiev, CEO of Gemcorp, meets Rosoboronexport’s CEO Alexander Mikheev to discuss arms sales in Angola.

• January 2019: Bulgaria revokes the citizenship of Sergey Adoniev, citing undisclosed criminal convictions.

• October 2019: At the Russia-Africa Summit, Gemcorp, Sberbank, and VEB.RF announce a $5 billion trade finance agreement to support Russian exports in Africa.

2020

• 2020: The Russian government consolidates Rusnano and the Skolkovo Foundation under VEB.RF’s control, centralizing state-backed technological and energy development.

2021

• May 3, 2021: Samantha Power was sworn in as Administrator of the U.S. Agency for International Development (USAID).

• June 2, 2021: U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Delyan Peevski for “significant corruption” under the Global Magnitsky Human Rights Accountability Act.

• July 13, 2021: Tony Podesta signed lobbying deals with Bulgarian company Protos Energy and its parent company INSA Oil, earning him over $500,000 between 2021 and 2022.

• August 16, 2021: Tony Podesta signed a $1.2 million contract with Hydrostroy JSC, a Peevski-linked company, for lobbying services.

• September 2021: John Podesta was appointed as Senior Advisor to President Biden for Clean Energy Innovation and Implementation, overseeing $370 billion in climate-related federal investments.

• September 30 – October 1, 2021: Tony Podesta met Delyan Peevski and his network in Dubai, reportedly monitored by Bulgarian intelligence.

• October 2021: Tony Podesta celebrated his birthday in Sofia, Bulgaria, with associates of Peevski in attendance.

• November 2021: Tony Podesta partnered with Momchil Mondeshki, a Bulgarian lawyer linked to Peevski, in a Bulgarian consulting firm.

• December 2021: Podesta’s contract to lobby for INSA Oil and Protos Energy ended.

2022

• January 8, 2022: Bulgarian journalist Atanas Tchobanov received a credible threat against his life from the U.S. Embassy in Sofia due to his investigations into Podesta’s lobbying.

• March 23, 2022: A $1 billion Memorandum of Understanding (MoU) was signed between Bulgaria’s Energy Ministry, Gemcorp Capital Management Ltd., and IP3 Corporation.

• June 2022: Bulgarian Prime Minister Kiril Petkov’s government was ousted in a no-confidence vote, after which he expelled 70 Russian diplomats from Bulgaria.

• July 2022: Bulgarian politician Desislava Trifonova questioned Gemcorp’s entry into Bulgaria during parliamentary hearings, demanding clarity on the government’s dealings.

• May 2022: Podesta Group registered lobbying efforts with the U.S. Senate on behalf of Gemcorp, with Tony Podesta reportedly earning $880,000 in 2022 and an additional $240,000 in 2023.

• September 2, 2022: John Podesta’s appointment as Senior Advisor to President Biden for Clean Energy Innovation and Implementation was formally announced by the White House.

2023

• January 26, 2023: U.S. Department of Treasury’s OFAC sanctioned Sergey Adoniev, an early investor in Gemcorp, for his connections to Russia’s defense sector and criminal convictions.

• February 10, 2023: U.S. Department of State publicly designated five Bulgarian officials due to their involvement in significant corruption.

2024

• March 4, 2024: Forbes published an article on Tony Podesta’s influence on U.S. energy policy through lobbying for QatarEnergy.

•March 6, 2024: John Podesta replaced John Kerry as U.S. Climate Envoy, gaining oversight of USAID and DFC projects.

•March 29, 2024: Gemcorp terminated its contract with Tony Podesta, ending his registered lobbying activities for the firm.

•April 2, 2024: VTB Bank EUROPE SE aka DEUTSCHLAND AG, removed from Russia related SDN List by OFAC.

•May 6, 2024: SBERBANK (SWITZERLAND) Ukraine-/Russia-related Designation Removal from SDN List.

•May 8, 2024: John Podesta approved $412 million in DFC funding for Milele Energy, Gemcorp’s subsidiary in Africa.

•September 18 – October 22, 2024: Linnaeus, D. posts on X (formerly Twitter) detailed Tony Podesta’s earnings from Protos and Gemcorp and John Podesta’s approval of DFC funding, garnering notable attention. Milele Energy subsequently took down its Teams page.

Further Investigations:

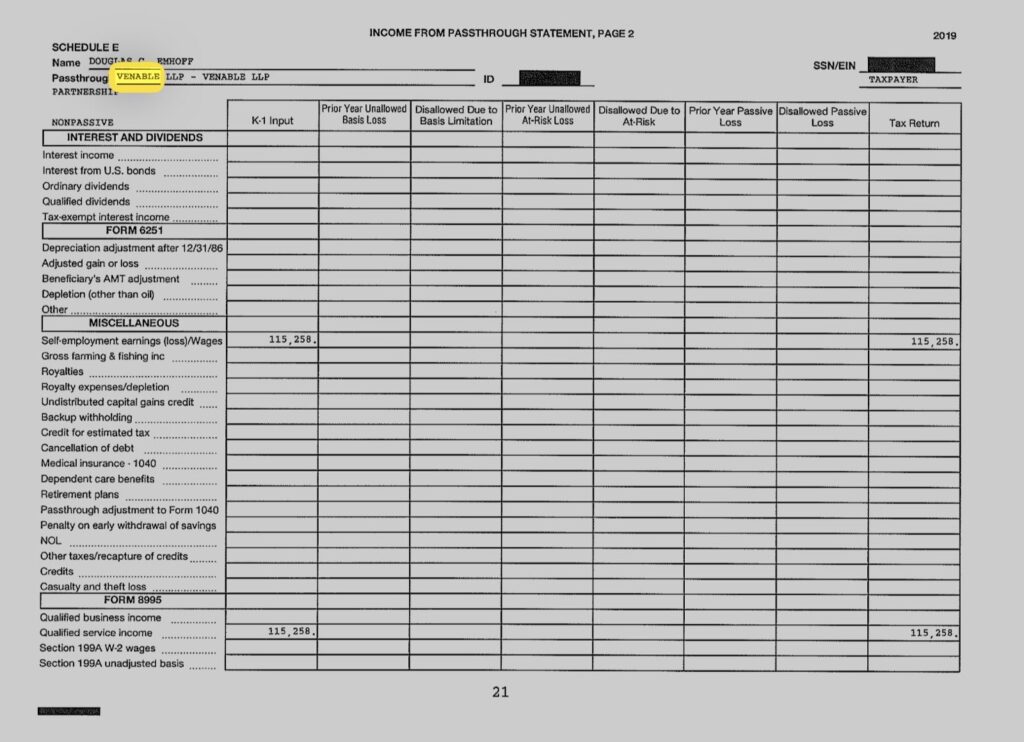

Gemcorp’s backing of Jumo World and Milele Energy and Russian influence networks and strategies in Arica, potential linkages to U.K. based firms and progressive networks (IPPR) and ties to John Podesta’s CAP, potential leverage of Carbon Tax schemes as Moscow-D.C.-London financial mechanisms and arteries for circumventing sanctions, potential links between Delyan Peevski offshore IGWT and Chai Patel (U.K.), linked to a network of elder homes embroiled in elder abuse scandals, Venable LLP lobbying for Sberbank and potentially improper OGE Forms 278e Harris-Kamala disclosures of Doug Emhoff’s retained interests in Venable.

OGE Forms 278e Harris-Kamala

- https://www.whitehouse.gov/wp-content/uploads/2021/05/Harris-Kamala-D.-2021-Annual-278.pdf

- https://www.whitehouse.gov/wp-content/uploads/2022/05/Harris-Kamala-D.-2022-Annual-278.pdf

Venable LLP lobbying for Sberbank 2017-2020

- 2017: https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2017&id=D000069925

- 2018: https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2018&id=D000069925

- 2019: https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2019&id=D000069925

- 2020: https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2020&id=D000069925

- 2021: https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2021&id=D000069925

- 2022: https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2022&id=D000069925

Delyan Peevski was involved in a RICO (Racketeer Influenced and Corrupt Organizations Act) case filed in the U.S. District Court for the Southern District of New York. The case, identified as case number 1-18-cv-110072, was initiated by the bankruptcy administrator of the U.S. company Air Logistics Ltd., with a substantial claim amounting to $200 million. The allegations centered on racketeering, money laundering, and other criminal financial activities aimed at tracing and combating illicit income sources .

However, the case was ultimately dismissed on January 28, 2022. Judge Gregory Woods ruled to terminate the proceedings, citing jurisdictional limitations and insufficient grounds for the U.S. court to entertain the claims against foreign defendants, including Peevski .

The case was against Lyutov and Kostadinchev, officials formerly responsible for financial and administrative duties for KTB which collapsed in 2014, Bulgarian National Bank as well as the Bank of New York Mellon, First Investment Bank, businessmen Tseko Minev, Ivaylo Mutafchiev and Delyan Peevski.

This timing is potentially important since the $1 billion IP3-Gemcorp March 2022 MoU with Bulgaria’s Ministry of Energy was signed two months after Peevski case was dropped. [Notes: Further Investigation References 1-3)

References:

Key Timeline Sources:

U.S. Agency for International Development. (n.d.). Office of the Administrator. https://www.usaid.gov/organization/office-administrator

U.S. Department of the Treasury. (2022, February 24). TU.S. Treasury Announces Unprecedented & Expansive Sanctions Against Russia, Imposing Swift and Severe Economic Costs. U.S. Department of the Treasury. https://home.treasury.gov/news/press-releases/jy0608

U.S. Department of the Treasury. (2022, December 2022). Treasury Further Constrains Russia’s Financial Services Sector. U.S. Department of the Treasury. Retrieved November 3, 2024, from https://home.treasury.gov/news/press-releases/jy1163

U.S. Department of the Treasury. (n.d.). Sanctions listing: VTB BANK PUBLIC JOINT STOCK COMPANY, Entry ID 17013. Office of Foreign Assets Control. https://sanctionssearch.ofac.treas.gov/Details.aspx?id=17013

U.S. Department of the Treasury. (2024, April 2). Recent actions. Removal SPECIALLY DESIGNATED NATIONALS LIST: VTB BANK PUBLIC JOINT STOCK COMPANY Office of Foreign Assets Control. https://ofac.treasury.gov/recent-actions/20240402

U.S. Department of the Treasury. (2024, May 6). Recent actions. Ukraine-/Russia-related Designation Removal. SBERBANK (SWITZERLAND) AG Office of Foreign Assets Control. Retrieved November 3, 2024, from https://ofac.treasury.gov/recent-actions/20240506

Overview: Gemcorp-Milele Relationship and U.S. Involvement Sources:

Gemcorp Capital. (2023, June 8). Gemcorp Capital seeds $150m Milele Energy transition platform. https://www.gemcorp.net/news/gemcorp-capital-seeds-150m-milele-energy-transition-platform

Gemcorp Capital CEO Interview on Milele Investment CNBC Africa. (2023, May 4). Gemcorp Capital’s CEO discusses $150M investment in Milele Energy [Video]. https://www.cnbcafrica.com/media/6326753162112/

Dyk, P. (2023). Congratulations to Milele Energy on its investment in the Lake Turkana wind project [LinkedIn post]. LinkedIn. https://www.linkedin.com/posts/philip-dyk_milele-energy-has-completed-the-purchase-activity-7059598877150130176-tdUi

Milele Energy Seeks Stake in Lake Turkana Wind Power Project Milele Energy. (2023, March). Milele Energy seeks stake in Lake Turkana Wind Power Project. https://milele-energy.squarespace.com/news/milele-energy-seeks-stake-in-lake-turkana-wind-power-project

Granskog, E. (2023). Milele Energy has completed the purchase of KP&P, the Dutch entity that was the original developer and a 25.25% stakeholder of the 310 MW Lake Turkana Wind Power Project [LinkedIn post]. LinkedIn. https://www.linkedin.com/posts/erikgranskog_milele-energy-has-completed-the-purchase-activity-7059380482337124352-BeI5

Svoboda, Karel. “Russia’s Loans as a Means of Geoeconomic Competition in Africa and Latin America.” Problems of Post-Communism, vol. 71, no. 2, 2024, pp. 156-166. Taylor & Francis Group, https://doi.org/10.1080/10758216.2022.2094808.

Milele Energy. (2024). The team – Experts in Africa’s clean energy market. http://web.archive.org/web/20240522095500/https://www.mileleenergy.com/meet-the-team

Note: Milele Energy’s “Meet The Team” page became unavailable after a social media post on X (formerly Twitter) was posted on Oct 22, 2024 garnering 4,552 views according to the platform’s public facing analytics. The post can be found here: Linnaeus, D. (2024, October 22) “Between 2022 and 2024, Anthony Podesta earned $1.12 million lobbying for Gemcorp. In 2024, his brother John Podesta approved $412 million in DFC funding for Milele Energy a Gemcorp firm. Why it matters.” X (formerly Twitter). https://x.com/DanLinnaeus/status/1848516248675471799

United States Agency for International Development. (2024, April). INVEST partner network (Publication No. 2403). USAID. https://www.usaid.gov/sites/default/files/2024-04/INVEST_PartnerNetwork%20(2403).pdf

Introduction Sources:

1, U.S. International Development Finance Corporation. (2024, May 8). DFC, Sierra Leone promote access to reliable energy with up to $412 million in additional financing and political risk insurance. https://www.dfc.gov/media/press-releases/dfc-sierra-leone-promote-access-reliable-energy-412-million-additional

2, Bulgarian National Radio. (2022, November 23). Parliament sets up ad-hoc committee to investigate USD 1 bn deal with Gemcorp. https://bnr.bg/en/post/101740793/parliament-sets-up-ad-hoc-committee-to-investigate-usd-1-bn-deal-with-gemcorp

3, Bulgarian National Radio. (2022, July 21). Bulgaria terminates the memorandum with Gemcorp. https://bnr.bg/en/post/101679650/bulgaria-terminates-the-memorandum-with-gemcorp

4, Stanchev, I. (2022, July 20). What stands behind the arcane $1 billion investment memorandum with Gemcorp and IP3 funds? Kapital Insights. https://kinsights.capital.bg/energy/2022/07/20/4344741_what_stands_behind_the_arcane_1_billion_investment/

5, Podesta, A. T. (2022, June 21). LD-1 Lobbying registration form for Gemcorp Capital Management Limited. United States Senate Lobbying Disclosure Act Database. https://lda.senate.gov/filings/public/filing/191a02f3-e3d2-402a-9fe8-6f1379a89f4d/print

6, Jack, Victor. “Putin Rakes in Extra €1B for His War Chest via Bulgaria Sanctions Loophole.” Politico, 9 Nov. 2023, https://www.politico.eu/article/how-russia-made-e1b-from-an-eu-sanctions-loophole-for-bulgaria/

7, “Bulgaria’s Fuel Exports Total BGN 2.2 Billion.” InfoBalkans, 15 Dec. 2023, https://www.infobalkans.com/2023/12/15/bulgaria-s-fuel-exports-total-bgn-22-billion

8, “Fuel Exports to Ukraine: Neither Secret, Nor through Lukoil.” KInsights, 20 Mar. 2023, https://kinsights.capital.bg/business/2023/03/20/4462238_fuel_exports_to_ukraine_neither_secret_nor_through/

9, Hall, B., & Foy, H. (2022, June 22). Bulgarian government ousted in blow to EU enlargement hopes. Financial Times. https://www.ft.com/content/c8fe88a3-df24-4b44-b8bb-64df547f12fb

10, Oliver, C. (2022, June 22). Bulgaria’s Petkov points finger at mafia and Russia as government collapses. Politico. https://www.politico.eu/article/bulgarian-pm-petkov-government-lose-no-confidence-vote/

11, RFE/RL’s Bulgarian Service. (2022, August 2). Bulgaria’s caretaker cabinet sworn in after government collapse. Radio Free Europe/Radio Liberty. https://www.rferl.org/a/bulgaria-caretaker-government-sworn-in-petkov-donev/31970586.html

Part I Sources:

1, New York Times Article: Vogel, Kenneth P. “Tony Podesta Weighs Return to Lobbying and Democratic Politics.” The New York Times, 8 July 2021, www.nytimes.com/2021/07/08/us/politics/tony-podesta-lobbying-democrats.html.

2, Washington Post Article: Hamburger, Tom, and Matt Zapotosky. “Tony Podesta, Vin Weber Say They Were Told Justice Department Dropped Probe into Whether They Violated Foreign Lobbying Rules.” The Washington Post, 24 Sept. 2019, www.washingtonpost.com/politics/tony-podesta-vin-weber-say-they-were-told-justice-department-dropped-probe-into-whether-they-violated-foreign-lobbying-rules/2019/09/24/36ce907e-deea-11e9-be96-6adb81821e90_story.html.

3, Lobbying disclosure forms reveal Anthony Podesta’s significant role in lobbying for Sberbank CIB USA, Inc., with reported activities focused on clarifying sanctions imposed by Executive Order 13660 following Russia’s annexation of Crimea. The forms show that Podesta Group received $110,000, $40,000 and $20,000 for lobbying efforts in 2016, addressing sanctions relief, and engaging with U.S. Congress, the Department of State, and the Department of Commerce. This establishes a clear financial link between Podesta’s lobbying and Russian interests post-sanctions.

Podesta Group. LD-2 Lobbying Disclosure Form. Clerk of the House of Representatives, Secretary of the Senate, 2016 – https://web.archive.org/web/20170516002524/https://soprweb.senate.gov/index.cfm?event=getFilingDetails&filingID=8A5BD4FB-2687-4CDF-9906-0A65F4D8D52B&filingTypeID=1

4, Tony Podesta was paid $170,000 by Sberbank, Russia’s largest bank, to lobby for the removal of U.S. sanctions imposed after Russia’s annexation of Crimea. The contract between Podesta Group and Sberbank ran from March through September 2016 and focused on influencing both Congress and the executive branch. This lobbying occurred while John Podesta served as campaign chairman for Hillary Clinton’s 2016 presidential run, raising questions about the alignment of Democratic leaders with Russian entities under sanctions.

An anonymous congressional aide, who met with Elena Teplitskaya, Sberbank’s board chairperson. The aide expressed frustration over the perceived hypocrisy of the Democrats, noting that while they were accusing Russia of meddling in the U.S. election to help Donald Trump, they were simultaneously holding closed-door meetings regarding the removal of sanctions on Russian banks like Sberbank.

“The Democrats are sitting there trying to convince us that the Russians are trying to throw the election to Trump…And then they’re with us here in the House and meeting directly with the administration behind closed doors on the issue of the sanctions. The hypocrisy could not be any richer.”

Pollock, Richard. “EXCLUSIVE: Dem Super-Lobbyist Podesta Got $170K to End US Sanctions On Russian Bank.” The Daily Caller, 6 Mar. 2017, https://dailycaller.com/2017/03/06/exclusive-dem-super-lobbyist-podesta-got-170k-to-end-us-sanctions-on-russian-bank/.

5, Bureau for Investigative Reporting and Data. (2022, January 8). Powerful US lobbyist aids businesses linked to sanctioned Bulgarian lawmaker, has joint company with notorious attorney. BIRD. https://bird.bg/en/powerful-us-lobbyist-aids-businesses-linked-to-sanctioned-bulgarian-lawmaker-has-joint-company-with-notorious-attorney/

6, White House. (2022, September 2). President Biden Announces Senior Clean Energy and Climate Team: John Podesta to Serve as Senior Advisor to the President for Clean Energy Innovation and Implementation; Ali Zaidi to Succeed Gina McCarthy as Assistant to the President & National Climate Advisor. White House Briefing Room. https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/02/president-biden-announces-senior-clean-energy-and-climate-team/